Certainty is Expensive

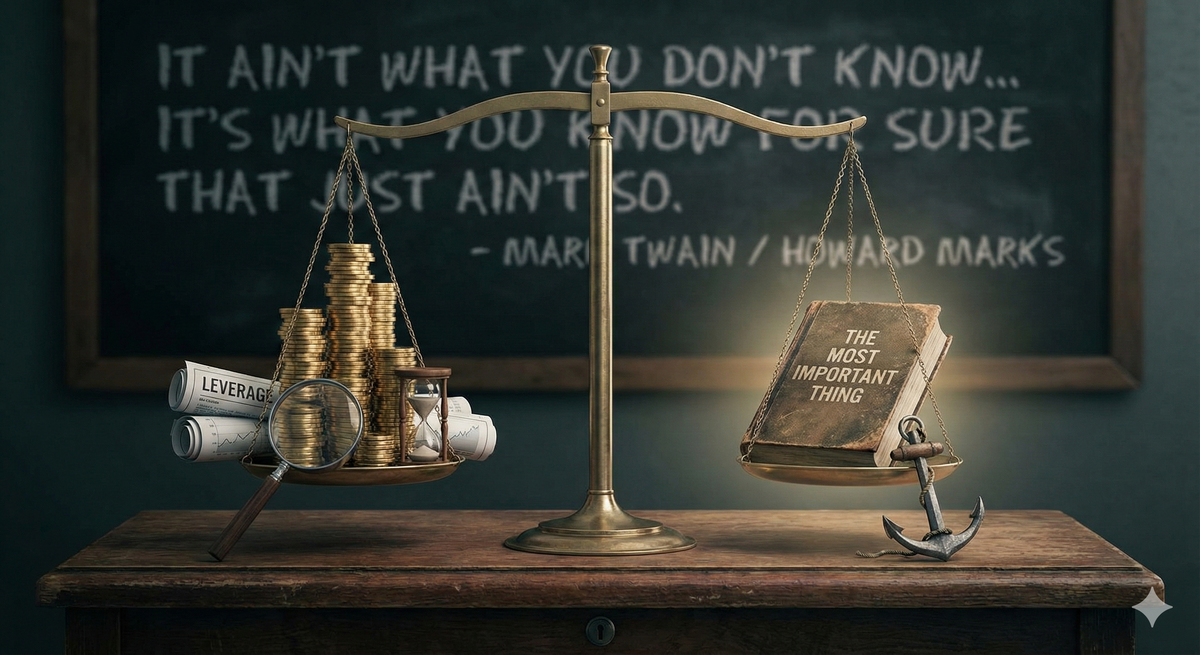

What is likely one of the best quotes about investing comes not from a famous investor but from Mark Twain, "It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so."

I give credit for connecting this quote to investing to Howard Marks in his book The Most Important Thing.

To me, this quote implies that it is usually more dangerous to be overconfident in a specific outcome than it is to be unaware or under-confident about a potential outcome.

Leverage is a good example of this overconfidence. Contrast a leveraged investor – who needs a specific situation to occur within a specific time frame – to the "long only" investor who simply buys, holds, and waits.

If you use debt or options for leverage, you may eventually run out of cash for interest payments or have your options expire worthless. Both of these lead to permanent loss of capital. In contrast if you go long-only on an investment and your thesis takes longer than expected to play out, you do not lose capital permanently.

Avoiding "what you know for sure that just isn't so" also applies to how an investor creates an investment strategy. For every thesis, it's worth understanding how the opposite might occur. It's also worth respecting the universes you have entirely failed to predict – what Donald Rumsfeld famously called "unknown unknowns".